Financial anxiety goes beyond simply worrying about money from time to time.

It is a persistent, often overwhelming sense of fear or stress related to your financial situation, even when things may objectively be “okay.”

Financial anxiety is a leading cause of depression, but its impact goes far beyond mood.

It can trigger chronic stress, insomnia, low self-esteem, panic attacks, difficulty concentrating, and even physical symptoms like headaches or high blood pressure.

It is not just about having little money; someone earning a comfortable salary can still feel trapped by debt, rising expenses, or fears about job security.

This guide will help you understand what financial anxiety is, why it happens, and most importantly, how to overcome it.

Whether you are struggling with debt, facing financial uncertainty, or simply feeling overwhelmed, there are practical steps you can take to reduce stress and build a healthier relationship with your finances.

Signs of Financial Anxiety

- Constant worry about money

- Physical symptoms like headaches, insomnia, or stomach issues

- Avoidance of looking at bank statements or credit card bills

- Feeling “frozen” or unable to make financial decisions

- Shame, guilt, or embarrassment around money topics

- Relationship strain due to money disagreements

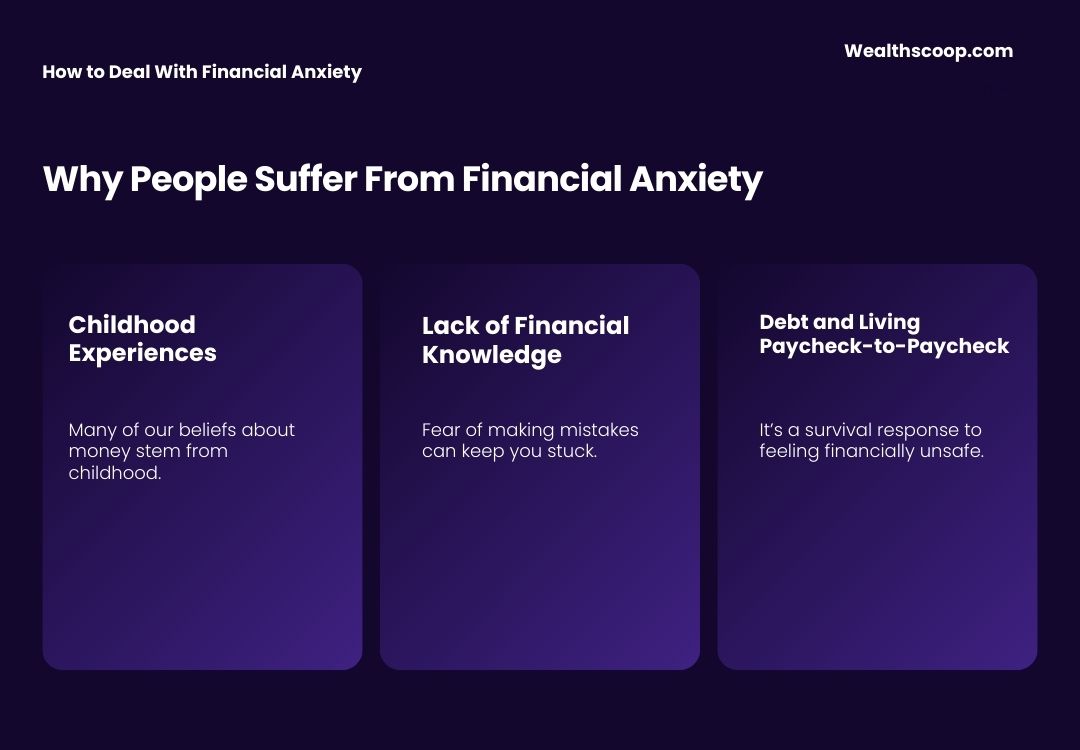

Why People Suffer From Financial Anxiety

Money anxiety can be about what money symbolizes in our lives, like safety, freedom, independence, success, and even our sense of self-worth.

Various factors, such as past experiences, cultural expectations, debt, job insecurity, and financial uncertainty, can all contribute to financial anxiety.

Here are the Factors that cause Financial Anxiety in an individual:

1. Life Events

Major life changes like job loss, divorce, illness, or a global pandemic can throw even the most stable finances into chaos and trigger anxiety.

2. Childhood Experiences

Many of our beliefs about money stem from childhood.

If you grew up in a home where money was scarce or arguments about finances were common, you might carry that anxiety into adulthood even if your financial situation has improved.

3. Debt and Living Paycheck-to-Paycheck

When you’re in debt or struggling to cover expenses, anxiety can feel constant. It’s a survival response to feeling financially unsafe.

Your brain goes into overdrive, trying to protect you from perceived threats, which can make even simple financial decisions feel overwhelming.

Over time, this state of worry can wear you down emotionally and mentally, creating a cycle that’s hard to break without the right tools and support

4. Social Pressure and Comparison

In today’s world of social media, it is easy to feel behind when friends and influencers post luxury vacations, new cars, or shopping sprees. The pressure to “keep up” can fuel anxiety.

5. Lack of Financial Knowledge

If no one ever taught you how to budget, save, invest, or handle debt, money might feel confusing and terrifying. Fear of making mistakes can keep you stuck.

How to Overcome Financial Anxiety

Financial anxiety is treatable.

Whether your anxiety stems from real financial struggles or fear of the unknown, there are practical steps you can take to reclaim peace of mind.

Here is how to start:

1. Name Your Feelings

The first step in managing financial anxiety is to recognize and name it. Instead of brushing it aside or feeling ashamed, try saying:

“I’m anxious because I feel unprepared for an emergency.”

“I’m worried about my debt because I’m not sure how to pay it off.”

“I feel embarrassed about my spending habits.”

2. Know Your Numbers

Many people avoid looking at their finances because they are afraid of what they will find.

Ironically, not knowing often feels scarier than reality.

Facing your numbers might feel uncomfortable, but it is essential for reducing anxiety. Start by:

- Writing down all sources of income.

- Listing monthly expenses.

- Gathering information on debts and interest rates.

- Checking bank balances and savings accounts.

Seeing your financial picture clearly can help replace fear with facts and allow you to make informed decisions.

3. Create a Simple Budget

A budget is a plan that puts you in control.

Knowing where your money is going is one of the most powerful ways to reduce anxiety.

Start small.

A simple budget might look like:

- Income: $3,000

- Rent: $900

- Groceries: $400

- Utilities: $150

- Transportation: $200

- Debt payments: $250

- Savings: $200

4. Focus on One Goal at a Time

Financial anxiety often comes from feeling overwhelmed. Instead of trying to fix everything at once, pick one priority.

- Pay off the smallest debt.

- Save $100 for emergencies.

- Set up automatic savings.

- Review your credit report.

Small victories build confidence and reduce anxiety.

5. Challenge Catastrophic Thoughts

Financial anxiety often feeds on worst-case thinking:

“If I lose my job, I will lose my house.”

“I will never get out of debt.”

“I’m terrible with money.”

Challenge these thoughts:

“I have skills and could find another job if needed.”

“Debt takes time to pay off, but I can create a plan.”

“I’m learning new ways to manage my finances.”

Replace fear with realistic, empowering thoughts.

6. Limit the Time Spent on Social Media

Comparing your life to others can fuel financial anxiety. Remember:

- Social media is a highlight reel, not reality.

- Many people who look wealthy online are deeply in debt.

- Your financial journey is unique, and that’s okay.

Consider taking a social media break or unfollowing accounts that trigger anxiety.

7. Seek Professional Support

Financial anxiety is common and treatable. Don’t hesitate to seek help:

Therapists can help you manage anxiety and understand emotional triggers.

Financial advisors or credit counselors can help you make a plan and feel more in control.

There is no shame in asking for support. Professionals exist to help you succeed.

8. Educate Yourself

Many people feel anxious because they simply do not understand finances. Knowledge replaces fear. Start small:

- Read a personal finance book.

- Listen to financial podcasts.

- Take a free online course.

The more you learn, the less intimidating money becomes.

9. Practice Stress Management

Financial anxiety is not just about money; it is also about your nervous system. Calm your body to calm your mind:

- Exercise regularly.

- Meditate or practice deep breathing.

- Spend time outdoors.

- Maintain hobbies and friendships.

Taking care of yourself helps you handle money stress more effectively. When you are physically and emotionally drained, even small financial worries can feel overwhelming.

10. Celebrate Your Progress

Do not wait until you are debt-free or wealthy to feel good about your progress. Celebrate:

- Paying off a credit card.

- Saving your first $100.

- Sticking to your budget for a month.

- Having a money conversation you’ve been avoiding.

Small wins build momentum and reduce anxiety.

Remember, financial anxiety may feel overwhelming right now, but it does not define who you are or what your future holds. It is a response to real stress, not a personal failure.

One of the most effective ways to overcome financial anxiety is to focus on building confidence with your money. Instead of feeling like money controls you, learning how to budget, save, and set achievable goals helps you regain control.

Building financial confidence is one of the best long-term strategies to ease money-related stress because it shifts your mindset from constant fear to practical action.

[…] constantly makes you feel stressed or overwhelmed, you may be dealing with financial anxiety. Here’s how to recognize and manage […]

[…] Unfortunately, decisions made in emotional states are often the ones that cause the most regret. For example, panic-selling investments during a downturn locks in losses, while overspending during stress only deepens financial anxiety. […]