For low-income earners, the idea of taking a loan can feel daunting.

Questions like “Will I be able to repay it?” and “What if I fall into debt?” are common fears.

Yet, when used wisely, loans can be powerful tools, offering access to funds that can transform lives and create opportunities that would otherwise be out of reach.

Dr. Helena Morris, Development Finance Specialist, says: “For low-income earners, access to credit can be a lifeline but only if it is affordable, transparent, and matched to the borrower’s capacity to repay. A loan should be an investment in a better future, not a gamble that risks pushing people deeper into debt.”

While loans can help in times of Emergency, we should also know that not all loans are equal. Some are fair and supportive, while others are costly and exploitative.

Understanding the various types of loans available worldwide is the first step toward borrowing safely and smartly, and making informed choices that protect your financial future.

Let us explore the different kinds of loans available globally for low-income earners, their benefits, risks, and how to choose the right option for your needs.

Why do you need a loan as a low-income earner?

1. Starting or growing a small business

Many low-income individuals run micro-enterprises selling goods in markets, farming, and offering services that require capital.

2. Medical emergencies

Unexpected health crises can wipe out savings, leaving families in financial distress.

3. Education

Whether school fees for children or vocational training for adults, education is a pathway out of poverty, but it costs money.

4. Household needs

Repairs, buying essential appliances, or securing housing may require lump sums that low-income earners can’t save quickly.

5. Coping with income gaps

Seasonal workers, farmers, and casual laborers may face months without a steady income.

Loans, when structured fairly, offer a lifeline in these situations. However, borrowing should always be approached with caution and proper planning.

Available loan options for low-income earners you can explore

1. Microfinance Loans

Microfinance loans are small sums provided primarily to people without access to traditional banking services. These loans often target micro-entrepreneurs and low-income households.

In developed countries (like the US, UK, and Canada), microfinance exists but on a much smaller scale, often in the form of community lending or non-profit programs targeting marginalized groups.

In some rural or remote regions of low-income countries, microfinance banks might not be physically present due to infrastructure challenges.

Take a moment to find out if microfinance banks or community lenders operate in your country or region.

Features:

- Small loan sizes (sometimes as low as $50 to $500)

- Minimal or no collateral

- Group lending models (especially for women’s groups)

- Often accompanied by training or business support

Example

- Grameen Bank (Bangladesh): Popularized microfinance by offering small loans to groups of women.

- SKS Microfinance (India): Provides loans to help women build small businesses.

2. Government-Subsidized Loans

One of the most powerful tools for helping low-income earners access affordable credit is government-subsidized loans.

Governments worldwide recognize that financial inclusion is key to economic growth.

Many offer subsidized loans to low-income earners for business, housing, education, or farming.

These are loans offered by the government or commercial banks under government programs where the government helps make borrowing cheaper or easier for certain groups of people.

Examples around the world:

- United States: SBA Microloans for small businesses (loans up to $50,000)

- United Kingdom: Start Up Loans with low interest for entrepreneurs

- India: Mudra Loans for micro and small businesses

- Brazil: Programa Nacional de Microcrédito Produtivo Orientado supports small businesses

- Nigeria: TraderMoni, FarmerMoni programs for small traders and farmers

Features:

- Lower interest rates than commercial banks

- Longer repayment periods

- Grace periods to help businesses stabilize

3. Salary Advance Loans

A salary advance Loan is a short-term loan given to salaried employees, allowing them to borrow money against their next paycheck. It is like getting part of your salary early, but with little interest or no interest attached

These loans let salaried workers borrow money against their upcoming paycheck. They are often used to cover emergencies like medical bills or rent.

Available in:

- United States

- Philippines

- Nigeria

- South Africa

Features:

- Quick approval (sometimes instant)

- No collateral required

- Small loan amounts tied to salary

4. Cooperative and Credit Union Loans

When traditional banks say “no,” cooperatives and credit unions often say “yes.”

These community-based financial institutions offer a lifeline to low-income earners by providing access to savings, affordable credit, and financial education all within a supportive, member-focused environment.

Credit unions and cooperatives are member-owned financial institutions. They pool members’ savings and offer loans at affordable rates.

Highly active in North America, Europe, Africa, and Southeast Asia

Features:

- Lower interest rates than commercial banks

- Personalized service

- Dividend sharing among members

5. Peer-to-Peer Lending (P2P)

Imagine borrowing money not from a bank but directly from other people.

That is the idea behind Peer-to-Peer (P2P) lending, a modern way for individuals to get loans online without traditional financial institutions in the middle

P2P lending connects borrowers directly with individual investors via online platforms, cutting out traditional banks.

Global Platforms:

- LendingClub (US)

- Funding Societies (Southeast Asia)

- Zopa (UK)

- RainFin (South Africa)

Features:

- Lower interest rates than traditional banks

- Easier for borrowers without a perfect credit history

6. Digital and Mobile App Loans

Borrowing money without leaving your home, no long bank queues, no paperwork, and approval in minutes.

That is the reality offered by digital and mobile loan apps, a booming trend transforming how people access credit worldwide.

For low-income earners, these apps can be a lifeline during emergencies or when traditional banks shut their doors. But they’re also risky if not used wisely.

The explosion of mobile technology has revolutionized borrowing. Today, millions can access instant credit through smartphone apps.

Popular Apps Globally:

- Tala (Kenya, Philippines, Mexico)

- Branch (Africa, Latin America, South Asia)

- FairMoney (Nigeria)

- Cashalo (Philippines)

- Dave, Earnin (US)

Features:

- Instant approval

- No paperwork required

- Accessible even to those without bank accounts

7. Agricultural Loans

For millions of low-income earners worldwide, agriculture is both a livelihood and a way of life. But farming is a risky business.

Farmers face unique challenges, such as weather, market volatility, and seasonal cash flows. Agricultural loans support them in buying seeds, equipment, livestock, or dealing with emergencies.

That is where agricultural loans come in, special loans designed to help farmers and rural entrepreneurs invest, produce, and survive tough seasons.

Global Providers:

- Governments (USDA loans in the US, NABARD in India)

- NGOs (like One Acre Fund in Africa)

- Development banks (African Development Bank, Asian Development Bank)

Features:

- Seasonal repayment plans tailored to harvest times

- Lower interest rates

- Additional support services like training

8. Education Loans

For low-income earners, education is one of the most powerful tools for breaking the cycle of poverty. But the cost of schooling tuition, books, accommodation, and transportation can be overwhelming.

That is why education loans exist: to help students and parents pay for studies today and repay gradually in the future.

From primary school to vocational training to university degrees, education loans open doors to better jobs and higher incomes.

Global Examples:

- Federal Student Loans (US)

- Student Loan Company (UK)

- Education loans through banks in India, South Africa, and Nigeria

Features:

- Helps low-income individuals improve their earning potential

- Some offer flexible repayment plans based on income

Challenges you may face when trying to take out a loan as a low-income earner

While many loan types exist, low-income earners still face significant obstacles:

1. Lack of credit history: Many have never borrowed, so lenders see them as high risk.

2. High interest rates: Even “small” loans can have high fees, making repayment hard.

3. Limited financial literacy: Without understanding loan terms, borrowers can fall into debt traps.

4. Collateral demands: Many banks require assets like land or vehicles, which low-income earners lack.

5. Digital exclusion: Not everyone has a smartphone or internet access to use digital loans.

These challenges make education and financial literacy critical so that borrowers know what they’re signing up for.

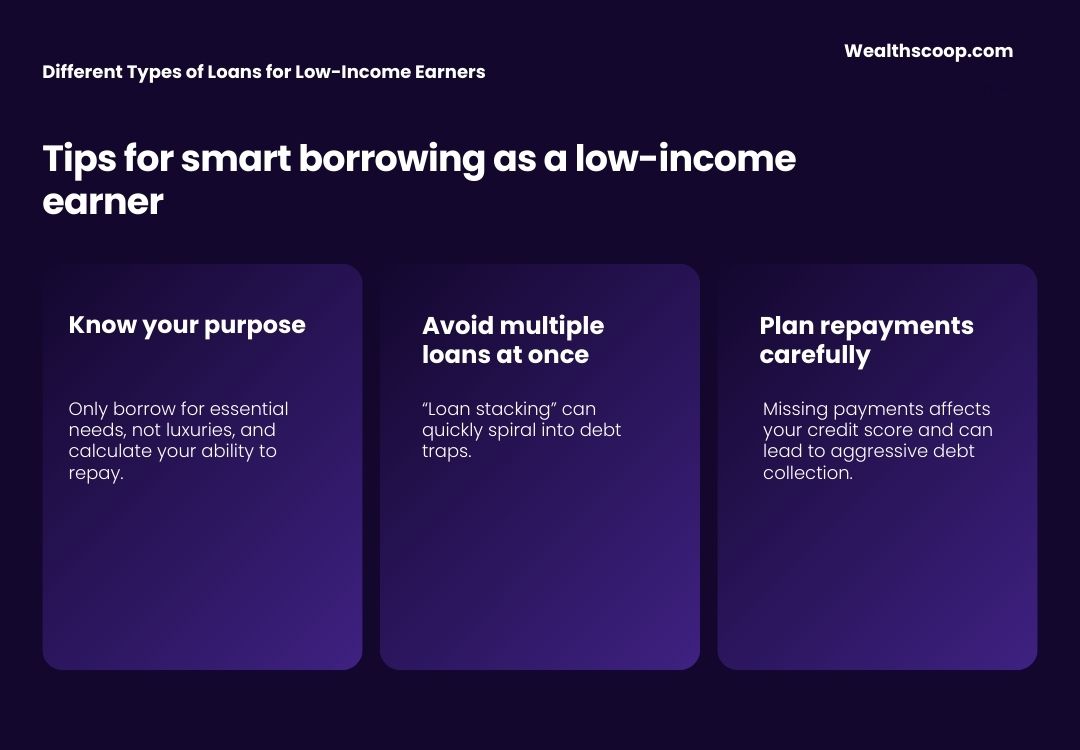

Tips for smart borrowing as a low-income earner

Here is how low-income earners anywhere in the world can borrow wisely:

1. Know your purpose. Only borrow for essential needs, not luxuries, and calculate your ability to repay. Do not borrow more than you can handle.

2. Compare options. Check interest rates from banks, cooperatives, digital apps, and government programs. Read the fine print. Know interest rates, fees, and consequences of late payment.

3. Avoid multiple loans at once. “Loan stacking” can quickly spiral into debt traps.

4. Borrow from trusted lenders. Check licenses and reviews to avoid scams.

5. Plan repayments carefully. Missing payments affects your credit score and can lead to aggressive debt collection.

Borrowing must be done wisely. High interest rates, hidden fees, and unmanageable repayments can push borrowers deeper into hardship.

Always understand the terms: ask questions, read the fine print, compare lenders, and choose reputable sources.

By learning how loans work, their benefits, and their risks, you can avoid financial traps and choose solutions that fit your needs.

Used responsibly, the right loan can be a stepping stone from surviving to thriving.