Regarding managing money wisely, two terms often dominate the conversation: saving and investing. Some people believe they should only focus on saving.

Others think investing is the smarter path. But the truth is, you need both to build a strong financial future.

Understanding the balance between saving and investing is crucial for achieving your short-term needs and long-term goals.

This article dives deep into what saving and investing mean, how they differ, the benefits and risks of each, and why combining both is the smartest move for your financial health.

Saving is putting money aside for future use, usually in a low-risk, easily accessible place like a savings account.

The primary goal of saving is safety and liquidity. You want to be sure the money is there when you need it.

Common Forms of Saving

- Savings accounts

- Fixed deposits (or CDs)

- Emergency funds

- Digital savings pots or jars

- Cash stashed safely (not ideal)

When Should We Save?

Saving is essential for short-term goals and emergencies.

Savings accounts are stable and low-risk; they are the perfect place for money you might need within the next 1 to 3 years.

Think about:

- Building an emergency fund

- Saving for rent, utility bills, or groceries

- Setting aside money for vacation

- Paying for school fees

- Buying a car or a laptop

While investing and saving may look similar, they are entirely different things.

Investing is putting your money into assets (such as stocks, bonds, real estate, or mutual funds) with the expectation of generating returns over time.

Investing comes with risk, but it also offers the potential for greater reward.

Common Forms of Investing

- Stocks and bonds

- Mutual funds

- Exchange-Traded Funds (ETFs)

- Real estate

When Should I Invest?

Investing allows your money to grow over time, often outpacing inflation. However, it requires patience and the ability to endure market ups and downs.

Investing is ideal for long-term financial goals, such as:

- Retirement planning

- Building generational wealth

- Saving for a child’s education (in 10+ years)

- Buying a house in the distant future

The Benefits of Saving

1. Financial Security

Having savings gives you peace of mind. You can handle unexpected expenses like car repairs, hospital bills, or job loss.

2. Liquidity

Savings are usually easy to access, offering high liquidity.

This means you can withdraw your money quickly whenever you need it, whether for emergencies, bills, or unexpected expenses. Unlike some investments that might take time to sell

3. Zero or Low Risk

Unlike investments, your savings don’t fluctuate with the market. The balance stays steady, so you always know exactly how much you have.

This stability makes savings a safe place for money you might need soon or for emergencies, giving you certainty and peace of mind.

4. Goal-Based Planning

Whether it’s for a wedding, school fees, a vacation, or a new gadget, savings help you prepare for important life events.

Setting money aside allows you to plan and cover the costs without stress or debt, making your goals more achievable and your finances more organized.

5. Financial Freedom

Saving regularly builds strong money habits and gives you greater control over your finances.

It helps you make choices without constantly worrying about money, paving the way for independence and peace of mind.

The Benefits of Investing

1. Wealth Creation

Over the long term, investing allows your money to work for you. Compound interest and market growth increase your wealth significantly.

2. Beating Inflation

Money saved in a bank account loses value over time due to inflation. Investing helps your returns outpace inflation.

3. Passive Income

Investments like dividend-paying stocks or rental properties generate ongoing income.

4. Financial Independence

Investing consistently can help you retire early or achieve financial independence.

5. Avoiding Debt

With money set aside, you’re less likely to rely on loans or credit cards for emergencies, helping you stay debt-free.

The Risks of Saving

1. Low Returns

Savings accounts offer minimal interest, often less than inflation. Over time, this erodes your money.

2. Loss of Opportunity

Money sitting in a low-interest account could’ve grown much faster if invested.

3. Inflation Risk

The biggest risk is inflation eroding your money’s purchasing power. If your savings earn 3% interest but inflation is 6%, you’re effectively losing value.

4. Liquidity Restrictions (some savings products)

Fixed deposits or savings bonds may lock your money for a time. Early withdrawal could mean penalties or loss of interest.

5. False Sense of Security

Having a large savings balance may feel safe, but it might not be enough to protect against big life events (medical crises, job loss, etc.) without a proper financial plan

The Risks of Investing

1. Market Volatility

Markets go up and down. You could lose money in the short term, especially if you panic and sell.

2. Requires Patience and Knowledge

Investing isn’t a “set it and forget it” plan. It requires research and a strong mindset.

3. Liquidity Issues

You may not be able to access your money quickly without penalties or losses.

4. Fraud or Scam Risk

There are fraudulent schemes and fake investment opportunities out there. Due diligence is crucial.

5. Credit/Default Risk

If you invest in bonds or lend money, there’s a chance the issuer (like a government or company) could default and fail to pay you back.

We need both saving and investing to thrive in this hard time

“Savings provide the safety net that keeps you financially grounded, while investments are the engine that drives your wealth forward. Without savings, you risk financial collapse in emergencies.

Without investments, you risk falling behind over time. The two work hand in hand to build lasting financial growth.”

— Dr. Helen Morris, Financial Strategist & Author of Wealth by Design

Saving and investing are both essential parts of managing money wisely.

While saving helps you keep money safe for emergencies and short-term needs, investing allows your money to grow and build wealth over time.

Depending on only one can leave yourself either vulnerable to unexpected expenses or unable to reach bigger financial goals.

Using both saving and investing together creates a strong financial foundation, offering security today and growth for the future

Too often, people fall into one of two traps:

- Saving everything and missing out on growth

- Investing everything and being unprepared for emergencies

Let us explore why this balanced approach is the best strategy

A balanced approach to saving and investing means using both strategies to protect your financial future.

Saving gives you quick access to money for emergencies and short-term goals, while investing helps your money grow over time and build wealth.

By combining them wisely, you stay prepared for unexpected expenses and also ensure your money keeps up with inflation and long-term plans.

This balance is key to achieving financial security and success.

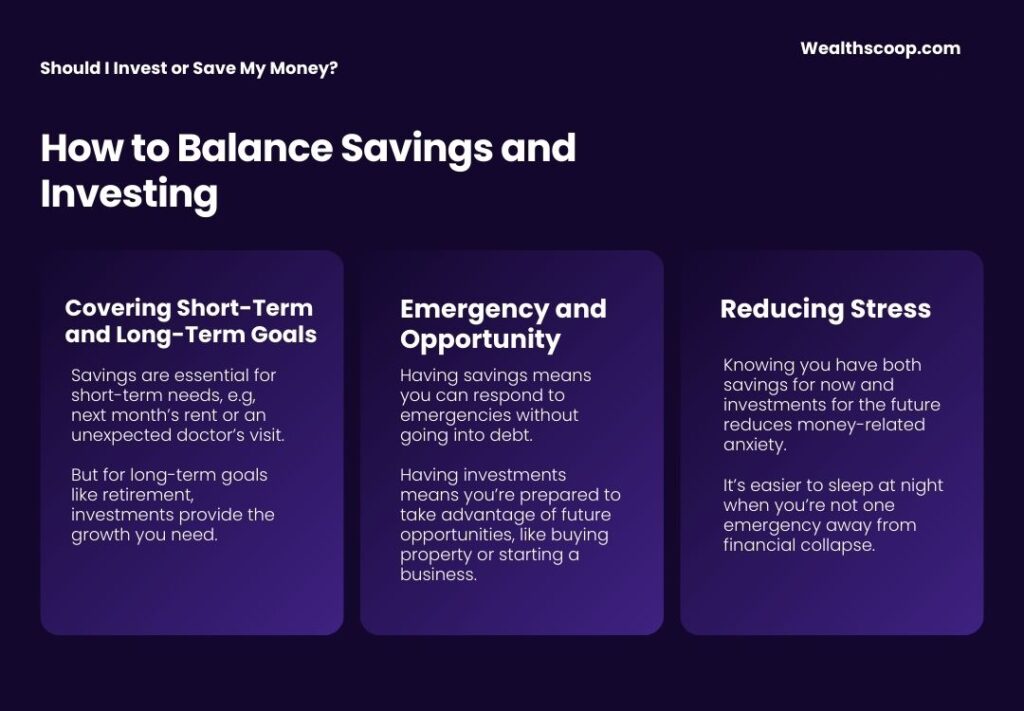

How to Balance Savings and Investing

1. Covering Short-Term and Long-Term Goals

Savings are essential for short-term needs, e.g, next month’s rent or an unexpected doctor’s visit. But for long-term goals like retirement, investments provide the growth you need.

2. Emergency and Opportunity

Having savings means you can respond to emergencies without going into debt. Having investments means you’re prepared to take advantage of future opportunities, like buying property or starting a business.

3. Reducing Stress

Knowing you have both savings for now and investments for the future reduces money-related anxiety. It’s easier to sleep at night when you’re not one emergency away from financial collapse.

4. Smart Use of Resources

Your income should work for you in different ways:

Save enough to be safe and secure

Invest enough to build wealth and freedom

5. Financial Security and Growth

Saving keeps you safe and stable; investing builds wealth and financial freedom.

Here is a step-by-step guide to managing saving and investing together:

Step 1: Build an Emergency Fund

Start by saving 3–6 months’ worth of living expenses. Use a high-yield savings account if possible.

Step 2: Define Your Goals

Separate your goals into short-term (0–2 years) and long-term (5–20 years). Save for the short term, invest for the long term.

Step 3: Automate Your Finances

Set up automatic transfers to your savings and investment accounts. Pay yourself first.

Step 4: Understand Your Risk Tolerance

Be honest about your comfort with risk. Young people can often afford to take more investment risk because they have time on their side.

Step 5: Start Small but Stay Consistent

You do not need to have a lot of money to start investing. Start with what you have. Consistency beats perfection.

Building a Balanced Financial Life

Saving keeps you safe; investing builds your future. Together, they create stability and growth.

Savings are your parachute, ready cash for emergencies like job loss or medical bills, giving you peace of mind.

Investments are your jetpack fueling long-term goals like retirement or homeownership, growing your wealth through compounding, and beating inflation.

Relying on only one leaves you exposed: just saving misses growth, just investing risks liquidity. Balancing both gives you security, confidence, and the power to thrive in any situation.