Emergency funds are not optional—they are essential.

If you don’t have money set aside, your only options might be borrowing, using credit cards, or skipping essential expenses.

With a solid emergency fund, those stressful moments become manageable.

But how much should you save? And how do you even start, especially if your budget already feels tight?

In this article, we’ll break down everything you need to know about building an emergency fund, from understanding why it matters to figuring out exactly how much is right for you, to practical strategies for growing it without overwhelming yourself.

Why You Need an Emergency Fund

An emergency fund isn’t just about money—it’s about control. It gives you breathing space during life’s disruptions. Here are the main reasons why it’s so critical:

1. Protection Against Job Loss

Losing a job is one of the most financially disruptive events you can face. With an emergency fund, you can cover essential expenses while searching for new work instead of panicking or taking the first opportunity that comes along.

2. Coverage for Unexpected Expenses

Cars break down, roofs leak, medical emergencies happen, and sometimes multiple expenses hit at once. Having an emergency fund means you won’t have to put these expenses on a high-interest credit card.

3. Freedom From Debt Cycles

Without a safety net, emergencies push people into borrowing. High-interest loans or credit card debt can linger for years, costing much more than the original expense. An emergency fund keeps you in control of your finances.

4. Mental and Emotional Security

Money stress is one of the top causes of anxiety and even relationship strain. Knowing you have cash set aside for emergencies reduces stress and helps you focus on long-term goals instead of short-term survival.

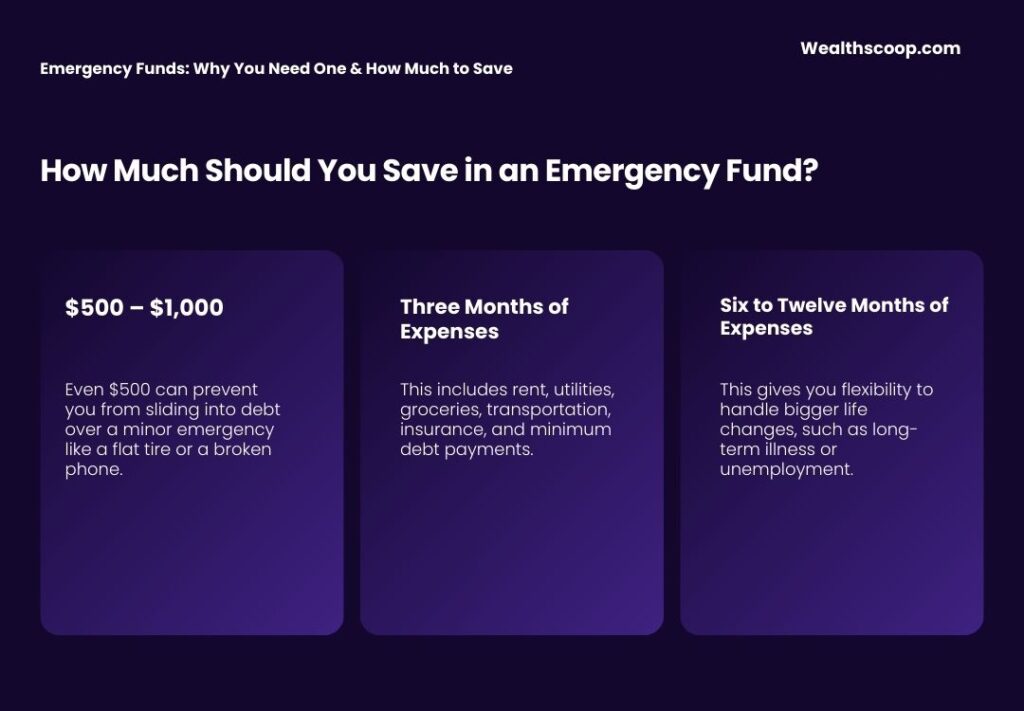

How Much Should You Save in an Emergency Fund?

The right amount depends on your lifestyle, responsibilities, and financial situation. There’s no one-size-fits-all number, but here are the most common guidelines:

1. Starter Fund: $500 – $1,000

If you’re just starting out, aim for a small safety net first. Even $500 can prevent you from sliding into debt over a minor emergency like a flat tire or a broken phone.

2. Three Months of Expenses

Once you’ve built a starter fund, expand it to cover at least three months of living expenses. This includes rent, utilities, groceries, transportation, insurance, and minimum debt payments.

3. Six to Twelve Months of Expenses

For maximum security, especially if you have dependents or unstable income, experts recommend saving six to twelve months of expenses. This gives you flexibility to handle bigger life changes, such as long-term illness or unemployment.

Once you’ve built your emergency fund, you may wonder whether to invest or save your extra money. Here’s how to decide what’s best for you.

Factors That Influence How Much You Should Save

Not everyone needs the same-sized emergency fund. Consider these factors to decide what’s right for you:

- Job Stability: If your job is stable with consistent pay, three months of savings may be enough. If you’re self-employed or in a volatile industry, lean toward six to twelve months.

- Dependents: Parents or caregivers need larger emergency funds to account for family needs.

- Health: If you have ongoing medical conditions, your fund should be more robust.

- Debt: If you’re carrying high-interest debt, balance saving with paying it down. Start with a small emergency fund, then focus on debt reduction before building it larger.

- Lifestyle Choices: Higher expenses mean you’ll need a larger cushion. Downsizing your lifestyle can also lower the amount you need to save.

How to Build Your Emergency Fund Step by Step

Building an emergency fund can feel overwhelming at first, but breaking it into manageable steps makes it easier.

1. Set a Clear Goal

Decide how much you want to save. Start with a small milestone ($500 or $1,000), then build toward three to six months of expenses. Having a number in mind helps you track progress.

2. Open a Separate Savings Account

Keep your emergency fund separate from your regular spending money. A high-yield savings account is ideal—it earns interest while remaining easily accessible.

3. Automate Your Savings

Set up automatic transfers from your checking account to your emergency fund each payday. Treat it like a bill you must pay. Even $20 or $50 per paycheck adds up over time.

4. Cut Back on Non-Essentials

Review your spending and temporarily reduce non-essential expenses. Small changes like eating out less, canceling unused subscriptions, or shopping more mindfully can free up cash for your fund.

5. Use Windfalls Wisely

Tax refunds, bonuses, or side hustle income can give your emergency fund a big boost. Instead of spending it all, allocate a portion to savings.

If you need more ideas to boost your progress, check out these 5 practical saving strategies that actually work.

6. Build in Layers

Think of it as building in stages:

- First, $500 – $1,000.

- Next, one month’s worth of expenses.

- Then, three months.

- Finally, six to twelve months, depending on your needs.

Where to Keep Your Emergency Fund

Accessibility is key. You need your emergency fund available quickly, but not so easy to access that you’re tempted to dip into it for non-emergencies. Here are smart options:

- High-Yield Savings Account (HYSA): Safe, FDIC-insured, and earns interest.

- Money Market Account: Similar to savings accounts but sometimes offers slightly better rates.

- Certificates of Deposit (CDs): Only useful for part of your fund, since they lock money for a set period.

- Cash at Home: Keep only a small amount of physical cash for immediate emergencies; the bulk should remain in a secure account.

When to Use Your Emergency Fund

An emergency fund is for true emergencies—not vacations, shopping sprees, or upgrades. Good reasons to use it include:

- Sudden medical expenses

- Urgent car or home repairs

- Job loss or reduced income

- Travel for family emergencies

- Essential bills you can’t otherwise cover

Always ask yourself: Is this unexpected, urgent, and necessary? If yes, it qualifies.

How to Rebuild After Using It

Using your emergency fund is not a failure—it means it served its purpose. The key is to start replenishing it right away:

- Pause extra spending temporarily.

- Redirect extra income into rebuilding the fund.

- Adjust your monthly savings goal until it’s restored.

- Revisit your budget to see if recurring expenses can be reduced.

Common Mistakes to Avoid

- Not Starting Because It Feels Overwhelming: Even $10 saved is progress.

- Keeping It in a Checking Account: Too easy to spend on non-emergencies.

- Using It for Planned Expenses: Birthdays, holidays, or vacations should be part of a regular budget—not taken from emergency funds.

- Neglecting to Refill It: After using it, make rebuilding a priority.

Final Thoughts

An emergency fund is your financial safety net. It shields you from the stress of unexpected expenses, protects you from falling into debt, and gives you peace of mind knowing you’re prepared for whatever comes.

Whether you start with just $500 or aim for six months of expenses, the key is consistency. Save a little at a time, keep it separate, and grow it step by step.

You may not be able to control life’s surprises, but you can control how prepared you are. Start building your emergency fund today—your future self will thank you.

[…] an emergency fund in place, you gain confidence and reduce the stress that often drives bad financial […]