Money is one of the trickiest parts of any relationship. For many couples, the question comes up sooner or later: “Should we share a bank account?” Some say it builds trust and teamwork, while others argue it leads to unnecessary conflict.

The truth? There isn’t a one-size-fits-all answer. What works beautifully for one couple could be a disaster for another. In this article, we’ll explore the pros, cons, and alternatives to sharing a bank account—so you can figure out what makes the most sense for your relationship.

Why This Question Matters in Relationships

Money is more than just numbers in an account—it’s about values, habits, and even identity. In fact, research shows financial issues are one of the top causes of stress between partners.

Think about it: Do you and your partner see money as something to save, or something to enjoy? Do you believe in budgeting every penny, or do you prefer spontaneity?

These differences, if left unspoken, can create unnecessary tension. That’s why deciding whether to combine finances isn’t just about convenience—it’s about how you want to live and grow together.

Why Sharing Can Bring You Closer (Pros)

Some couples swear by a shared bank account because it makes life easier and strengthens their bond. Here’s why:

Transparency Builds Trust

When couples share a bank account, financial transparency becomes the default. Both partners can clearly see how money is earned, spent, and saved, which helps remove any sense of secrecy. This visibility often builds trust because it eliminates the suspicion or worry that one partner might be hiding purchases or debts.

It also encourages accountability, since both people are aware of the household’s financial situation. Instead of money becoming a source of mystery or stress, it becomes an open book. For many couples, this openness strengthens the foundation of honesty and trust in their relationship.

Simplicity & Less Stress

Managing money as a team can get complicated when each person has separate accounts. Who pays the rent? Whose card should cover groceries?

Are you splitting streaming subscriptions? A shared account cuts through this confusion. Instead of juggling multiple transfers or calculating reimbursements, all the household expenses are pulled from one place.

This reduces stress and makes day-to-day money management far smoother. When bills are on autopilot and paid from a single account, couples spend less time worrying about logistics and more time focusing on their relationship.

Simplicity in finances often translates to peace of mind at home.

Teamwork Mentality

A joint bank account reinforces the mindset that it’s not just “my money” or “your money,” but our money.

This shift can help couples feel more united when it comes to financial decisions. Instead of one person carrying the weight of paying for certain bills while the other covers different ones, both contributions blend together toward shared responsibilities.

This teamwork creates a stronger sense of partnership because financial planning becomes a joint effort, whether that’s budgeting for everyday expenses or saving for long-term dreams. The result? Couples start to view themselves as a team working toward common goals.

If you’re just starting out, it helps to think beyond shared accounts and focus on building a money plan together that fits both partners.

Shared Goals Feel More Achievable

One of the biggest benefits of a joint account is how motivating it can be when working toward shared goals.

Saving for a big purchase—whether it’s a wedding, buying a home, traveling, or even retirement—feels more attainable when both partners are contributing to the same pot. Instead of managing separate savings and trying to combine funds later, couples can watch progress grow together in real time.

Seeing that account balance rise becomes a joint victory and creates excitement about the future. It’s a visual reminder that both partners are equally invested in building the life they want together.

Efficiency in Everyday Life

Household expenses can quickly pile up: rent, electricity, internet, groceries, and dozens of other small costs. With separate accounts, there’s often debate over who covers what or awkward calculations at the end of the month.

A joint account eliminates these issues by streamlining daily financial responsibilities. Bills are paid from one pool, so no one feels overburdened or confused. Even simple errands, like grabbing groceries, become smoother when both partners use the same card.

This efficiency helps reduce friction in everyday life. Instead of money becoming a recurring point of stress, it becomes a system that works effortlessly in the background.

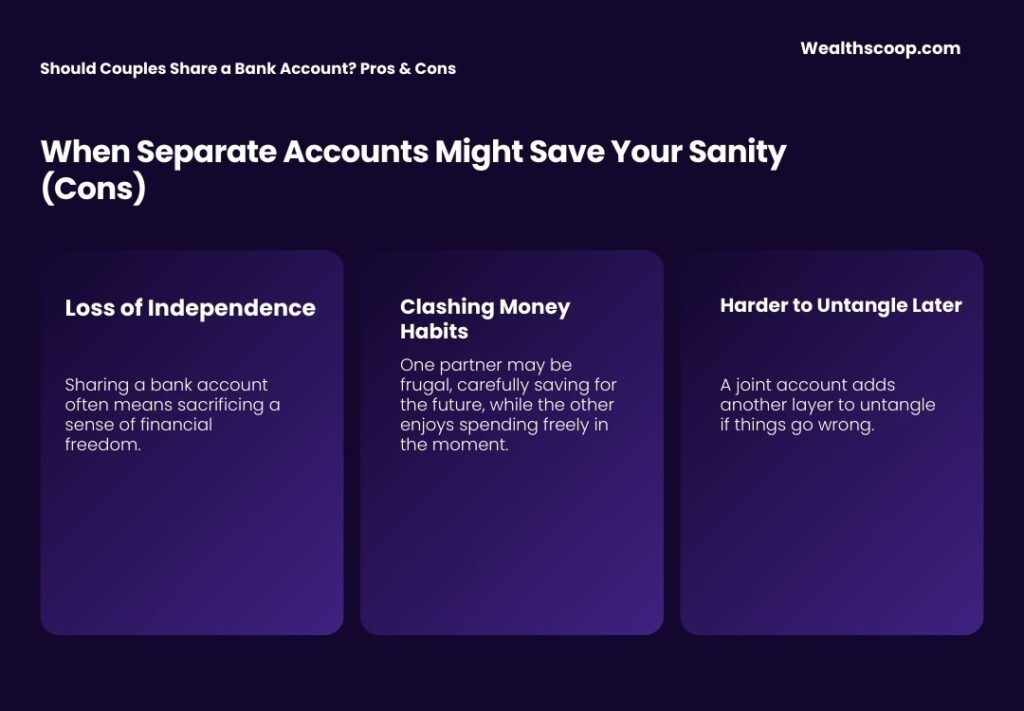

When Separate Accounts Might Save Your Sanity (Cons)

Of course, sharing isn’t all sunshine. For some couples, it creates more problems than it solves. Here’s what to watch out for:

Loss of Independence

Sharing a bank account often means sacrificing a sense of financial freedom.

Every purchase—whether it’s a coffee on the way to work, a new pair of shoes, or a hobby-related expense—is visible to your partner. For some people, this constant visibility can feel like being monitored, even if no judgment is intended.

Over time, the lack of privacy can create frustration or guilt about spending on personal wants. Independence in finances allows for small joys without explanation, and when that disappears, resentment can build.

A healthy relationship sometimes requires each partner to still enjoy financial autonomy.

Clashing Money Habits

Everyone has a different relationship with money. One partner may be frugal, carefully saving for the future, while the other enjoys spending freely in the moment.

When all transactions flow through a joint account, these differences can clash in stressful ways. The saver may feel anxious about every “unnecessary” purchase, while the spender may feel judged or restricted. Instead of building trust, money can become a battleground.

Small disagreements about takeout or shopping can quickly escalate into larger conflicts. Without clear agreements, combining accounts can magnify these differences and turn financial habits into ongoing sources of tension.

Unequal Contributions Create Tension

Income differences are common in relationships, but when couples share one account, these gaps can become a point of strain.

The higher-earning partner may feel like they’re contributing more, leading to resentment, while the lower-earning partner may feel guilt or insecurity. This imbalance can create an invisible power dynamic where money equals control.

Without clear conversations about fairness, the shared account may feel less like a partnership and more like dependency.

Couples who don’t openly discuss how much each person contributes risk building unspoken tension that seeps into other areas of the relationship, from decision-making to self-esteem.

Control Issues

Money is power, and in some relationships, a shared bank account can tip that balance in unhealthy ways.

One partner may take charge of managing the finances—choosing how money is spent, saved, or invested—leaving the other with little input. While sometimes this happens out of convenience, it can also create feelings of exclusion or even control.

The partner without access or influence may feel powerless, like they’re not an equal in the relationship. Over time, this imbalance can erode trust and respect.

A joint account only works when both people feel they have equal say in financial decisions.

Harder to Untangle Later

It’s not pleasant to think about, but not all relationships last forever.

When couples share one account, separating finances after a breakup can be complicated and emotionally charged. Who gets what if you’ve been saving together?

What if one person contributed more, or if debts were paid from that account? Even in strong relationships, this risk lingers in the background.

Having shared finances can make ending things far more difficult than it needs to be. While love is about trust, being practical about potential outcomes is important.

A joint account adds another layer to untangle if things go wrong.

The Middle Ground: Yours, Mine, and Ours

Not ready to go all-in on a shared account? You don’t have to. Many couples use a hybrid system that offers the best of both worlds.

- Separate Accounts Only

Each partner keeps their own account and pays their share of expenses. This works well for couples who value independence. - The Hybrid Model

Keep one shared account for joint expenses (like rent, bills, and groceries), while also maintaining personal accounts for individual spending. It’s flexible and reduces conflict. - Proportional Contributions

Instead of splitting bills 50/50, contribute a percentage of your income to the shared account. For example, if one earns 70% of the household income, they contribute 70% of shared costs.

This setup lets you enjoy the benefits of shared financial responsibility while still having breathing room for personal spending.

If You Do Share, Make It Work Smoothly

If you and your partner decide to open a joint account, a few ground rules can help prevent headaches:

- Agree on a Monthly Budget – Decide together how much goes to bills, savings, and discretionary spending.

- Set Personal Spending Limits – Some couples agree that purchases over a certain amount should be discussed first.

- Schedule Money Check-Ins – A quick monthly chat keeps both partners on the same page.

- Use Apps or Tools – Track shared spending easily with budgeting apps like YNAB, Mint, or Splitwise.

- Don’t Forget an Emergency Fund – Whether joint or individual, a safety cushion ensures you’re both protected.

Final Thoughts: The Best Choice Is Yours

So, should couples share a bank account? The answer depends on your personalities, values, and financial goals.

For some, a shared account creates trust, unity, and simplicity. For others, it feels restrictive and stressful. And for many couples, the hybrid approach offers the perfect balance between teamwork and independence.

The key is not the account itself—but the conversations and trust behind it. Start with honesty, explore your options, and choose the system that feels fair and sustainable for your relationship.