Living paycheck to paycheck can feel like being stuck on a hamster wheel — no matter how hard you run, you’re always a step behind. Bills, debt, and unexpected expenses pile up, leaving you anxious about money and unable to plan for the future.

But here’s the truth: financial confidence isn’t just for the wealthy. It’s a skill you can build, step by step, by changing your relationship with money and learning how to manage it with clarity. In this guide, we’ll break down practical strategies to help you move from paycheck-to-paycheck stress to financial freedom.

1. Understand Your Money Story

Financial confidence doesn’t begin with numbers; it begins with self-awareness. Every decision you make about money is shaped by the story you’ve been carrying — often without even realizing it.

Maybe you grew up in a household where money was scarce, and now you feel guilty spending even when you can afford it. Or perhaps your parents never talked about money at all, leaving you to figure things out on your own with a mix of trial, error, and stress.

Your “money story” influences how you react today. Avoiding your bank app, overspending when you’re stressed, or constantly worrying about “never having enough” are signs of deeper emotional patterns.

Recognizing them isn’t about blame — it’s about awareness. Because once you see where your fears or habits come from, you can start rewriting them.

If money constantly makes you feel stressed or overwhelmed, you may be dealing with financial anxiety. Here’s how to recognize and manage it.

2. Track Every Dollar (Without Shame)

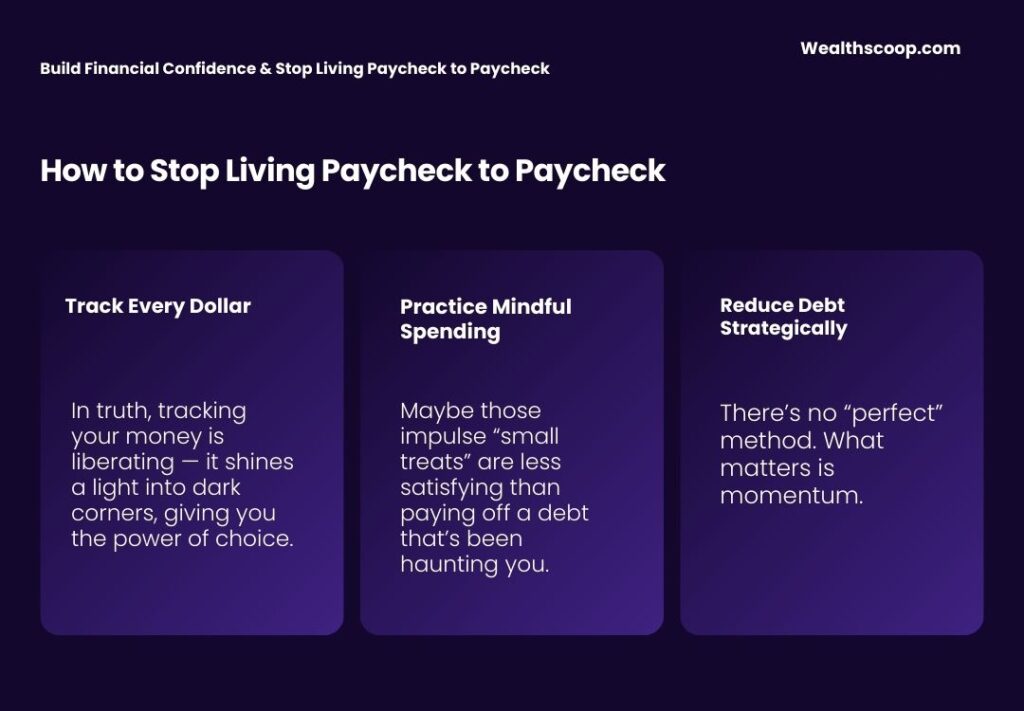

Budgeting is often misunderstood. Many think of it as a punishment, a list of “can’t haves” that makes life feel smaller. In truth, tracking your money is liberating — it shines a light into dark corners, giving you the power of choice.

When you write down where your money actually goes, you often discover surprising patterns. That “one quick coffee” or “cheap online order” that doesn’t seem like much can add up to hundreds over a month. The key here is to approach tracking with curiosity, not judgment. It’s not about shaming yourself — it’s about giving yourself the information you need to make better decisions.

After just a few weeks of tracking, you may notice you feel calmer, simply because you know what’s happening with your money. Awareness leads to control, and control leads to confidence.

3. Build a Safety Net

Imagine how much lighter your shoulders would feel if, the next time your car broke down or your child needed a doctor’s visit, you had cash waiting to cover it. That’s the power of a safety net.

Living paycheck to paycheck is stressful largely because every setback feels like a financial crisis.

The good news? You don’t need thousands of dollars to start. Even $50 or $100 set aside can create a small but mighty sense of relief. Start with a short-term goal, like saving $500. Keep it in a separate savings account so you’re not tempted to dip into it.

Once you see your emergency fund growing, you’ll feel the shift. Suddenly, money doesn’t just flow out — it begins to build up. That feeling of having your own back is where true financial confidence begins.

4. Practice Mindful Spending

So often, we spend money automatically — swiping cards, clicking “buy now,” or subscribing to services we don’t even use. Over time, these unconscious habits drain not only our accounts but also our confidence. Mindful spending flips the script.

It means pausing before each purchase and asking: Is this aligned with what I truly value? Maybe you realize that takeout three times a week doesn’t actually make you happy, but saving for a weekend getaway with friends does.

Maybe those impulse “small treats” are less satisfying than paying off a debt that’s been haunting you.

Mindful spending isn’t about restriction. It’s about redirecting your money into what matters most, so each dollar works for you instead of against you.

Learn more about how mindful spending helps you make intentional financial choices instead of living on autopilot.

5. Reduce Debt Strategically

Debt is like carrying a heavy backpack everywhere you go — it slows you down, exhausts you, and makes it nearly impossible to feel confident about money. But once you start paying it down strategically, that weight gets lighter.

The debt snowball method is powerful for those who need motivation fast. Imagine clearing a small credit card balance and suddenly having one less bill to worry about. That “win” fuels your energy to tackle the next one.

On the other hand, the debt avalanche method appeals to the logical side — by tackling the highest interest first, you save more in the long run.

There’s no “perfect” method. What matters is momentum. Each debt you pay down frees up cash flow, and with each step forward, you begin to see that financial freedom isn’t just possible — it’s within reach.

6. Increase Your Earning Potential

There’s only so much you can cut before you feel deprived. The real breakthrough in escaping paycheck-to-paycheck living often comes from the other side of the equation: earning more.

This doesn’t always mean switching careers overnight. It could start with negotiating a raise, especially if you’ve been adding value at work.

Or it might mean monetizing a skill you already have — writing, design, tutoring, or freelancing online. Even a few extra hundred dollars a month can be the difference between constantly scrambling and finally saving.

Longer-term, investing in your skills pays the highest dividends. Online certifications, training programs, or networking can open doors to better-paying opportunities.

Confidence grows when you know you’re not capped — that you have the power to increase your financial potential.

7. Build Money Habits That Last

Financial confidence isn’t a one-time project. It’s the result of consistent habits that slowly rewire your relationship with money.

Think of them as small daily rituals that add up to big shifts: checking in on your budget once a week, setting an automatic transfer to savings, or even celebrating when you reach a milestone.

The key is consistency, not perfection. Even if you slip up — overspend one week, miss a savings goal — the habit of coming back to your plan keeps you on track. Over time, these actions compound, just like interest.

And here’s the beautiful part: as you build habits that work, your confidence becomes self-sustaining. You stop dreading payday because you’re no longer living paycheck to paycheck. Instead, you feel in control, prepared, and optimistic about the future.

Your Path to Financial Confidence

Breaking free from the paycheck-to-paycheck cycle isn’t about earning millions or never making mistakes with money. It’s about creating stability, clarity, and habits that allow you to feel secure no matter what life throws at you.

Financial confidence grows one small step at a time. It starts when you decide to face your money story instead of ignoring it. It builds as you track where your money goes, set aside even a small emergency fund, and choose to spend with intention rather than impulse.

Over time, every action compounds — and those little shifts are what move you from financial stress to financial freedom.

The truth is, money will always play a role in your life. The difference lies in whether it controls you or you control it. Confidence doesn’t come from having “enough” money — it comes from trusting your ability to manage what you have, and knowing you have a plan for the future.

And if you’re ready to go deeper into aligning your spending with your values and goals, our guide to mindful spending will show you how to make money choices that feel good in the long run.

Every paycheck you receive is an opportunity — not just to pay bills, but to create the life you want. Confidence means stepping into that opportunity with clarity, courage, and control.

The first step is yours to take, and the results will carry you further than you think.

[…] Building financial confidence is one of the best long-term strategies to ease money-related stress because it shifts your mindset from constant fear to practical action. […]