Imagine your child as an adult, confidently managing their finances, saving for the future, avoiding debt traps, and making wise decisions that bring them freedom and security.

That vision begins with the lessons they learn today.

Money is not just numbers, it shapes our choices, stress, and opportunities. Yet many grow up without the financial skills they need because money was not discussed at home, leaving them to learn through costly trial and error.

Teaching kids about money early is a lasting gift, giving them skills and confidence to handle life’s ups and downs. And it’s never too early or too late to start.

So in this article, we will explore why financial education is so important, what kids should learn at different ages, and practical ways to turn everyday moments into money lessons.

Whether your child is a preschooler learning to identify coins or a teenager ready to open a bank account, there are simple, engaging ways to help them become financially smart and secure.

Why it is important to teach kids about money as parents

As a parent, I have learned that teaching kids about money is not a single conversation, it is a journey that evolves as they grow.

I remember the first time my preschooler asked me why we could not buy every toy we saw at the store. In that moment, I realized that money lessons start much earlier than I expected.

By the age of 7, many of our core money habits and attitudes are already set. Children absorb lessons from watching their parents, hearing conversations, and observing how money is handled at home.

If they never see their parents budget, save, or talk calmly about financial choices, they may enter adulthood without the tools to manage their finances wisely.

How financial literacy at an early stage helps children in the long run

1. Builds Strong Money Habits Early

Children who learn about saving, budgeting, and spending wisely from a young age tend to carry those habits into adulthood. They are less likely to fall into debt traps or live paycheck to paycheck.

2. Encourages Goal-Oriented Thinking

Understanding money early helps kids set realistic goals, whether it is saving for a toy, paying for college, or starting a business. This mindset translates into better long-term planning as adults.

3. Reduces Risk of Poor Financial Decisions

Adults who never learned about credit, loans, or interest rates often make costly mistakes. Early exposure teaches kids how to weigh risks and rewards before committing to financial choices.

4. Promotes Independence and Responsibility

When children grasp the concept that money is earned, not magically available, they become more self-reliant and responsible with resources as they grow older.

5. Boosts Confidence in Handling Money

Just like learning a language young makes it easier to master, learning money skills early boosts confidence, making financial tasks like budgeting, investing, or negotiating salaries feel natural.

6. Encourages Generational Wealth-Building

Children raised with sound financial principles are more likely to invest, own assets, and pass down wealth-building habits to the next generation, breaking cycles of financial struggle.

How to Teach Kids About Money

Teaching Preschoolers (Ages 3-7): Planting Early Seeds

Young children can grasp simple money concepts.

The goal at this age is to introduce money as a tool used to exchange for goods and services and to lay the foundations for understanding value, choice, and patience.

Key Lessons for Ages 3-7

1. What Money Is and How We Use It

Show coins and bills. Let kids touch, count, and sort money.

Play “store” with toys or household items so they can “buy” and “sell” things.

2. Needs vs. Wants

Help kids distinguish between things we must have (food, shelter, clothes) and things that are nice but not essential (toys, treats).

3. Saving is Important

Use a clear jar for savings. Kids love watching money grow. Talk about saving for a toy or outing and how waiting can pay off.

Fun Activities you can try to teach Young Kids about money:

- Money Scavenger Hunt: Hide coins around the house and let kids find and identify them.

- Story Time: Read picture books about money, like Bunny Money by Rosemary Wells.

- Shopping Helper: Let them hand over cash or coins at the store and get change.

Teaching Elementary Kids (Ages 8-12): Building Practical Skills

Elementary-age kids can understand more about earning, saving, and spending. They’re old enough to start connecting effort with money and can handle more responsibility.

Key Lessons for Ages 8-12

1. Earning Money

Introduce the concept of working to earn money. Consider an allowance tied to chores.

2. Saving for Goals

Help kids set realistic savings goals. For example, saving $20 for a toy over four weeks. Break goals into manageable steps to teach planning and delayed gratification.

3. Spending Wisely

Teach kids to think before buying: “Do I need this?” or “Could I find it for less?”

4. Budgeting Basics

Introduce simple budgeting: divide money into categories like spending, saving, and giving.

Activities for Elementary Kids

- Goal Charts: Create a visual tracker showing how close they are to reaching a savings goal.

- Price Comparisons: Next time you shop, compare prices and talk about why some items cost more.

- Family Budget Talks: Include them in conversations about budgeting for a vacation or a big purchase.

When kids see that even adults make choices and sometimes delay gratification to afford what they want, it teaches them valuable lessons about planning, prioritizing, and managing money wisely.

Teaching Teens (Ages 13-18): Preparing for Real-World Responsibility

Teenagers are on the cusp of independence.

They’re capable of understanding complex financial topics like banking, credit, and long-term savings. It’s essential to give them practical experiences while they’re still under your roof.

Key Lessons for Ages 13-18

1. Banking and Accounts

Help teens open a savings or checking account. Teach them how to track deposits, withdrawals, and balances.

Explain bank fees, interest, and online banking safety.

2. Earning and Managing Income

Encourage part-time jobs, freelance work, or entrepreneurial ventures.

Discuss taxes and how earning money comes with responsibilities.

3. Credit and Debt

Explain credit cards, interest rates, and the risks of borrowing money unnecessarily.

Show how debt can quickly grow if not paid off promptly.

4. Budgeting and Expenses

Teach teens to plan for expenses like transportation, phone bills, social outings, or saving for college. Encourage tracking spending to see where money goes each month.

5. Long-Term Saving and Investing

Introduce concepts like compound interest, retirement accounts, and investing basics. Even if they are not investing yet, it plants a seed for future curiosity.

Activities for Teens to teach them about Money:

- Bill Simulations: Give teens “mock” bills to pay from an allowance or earnings so they experience budgeting firsthand.

- Research Projects: Assign a topic like “How credit cards work” or “Ways to save for college.”

- Money Challenges: Challenge your teen to save a specific amount in a month and discuss strategies to achieve it.

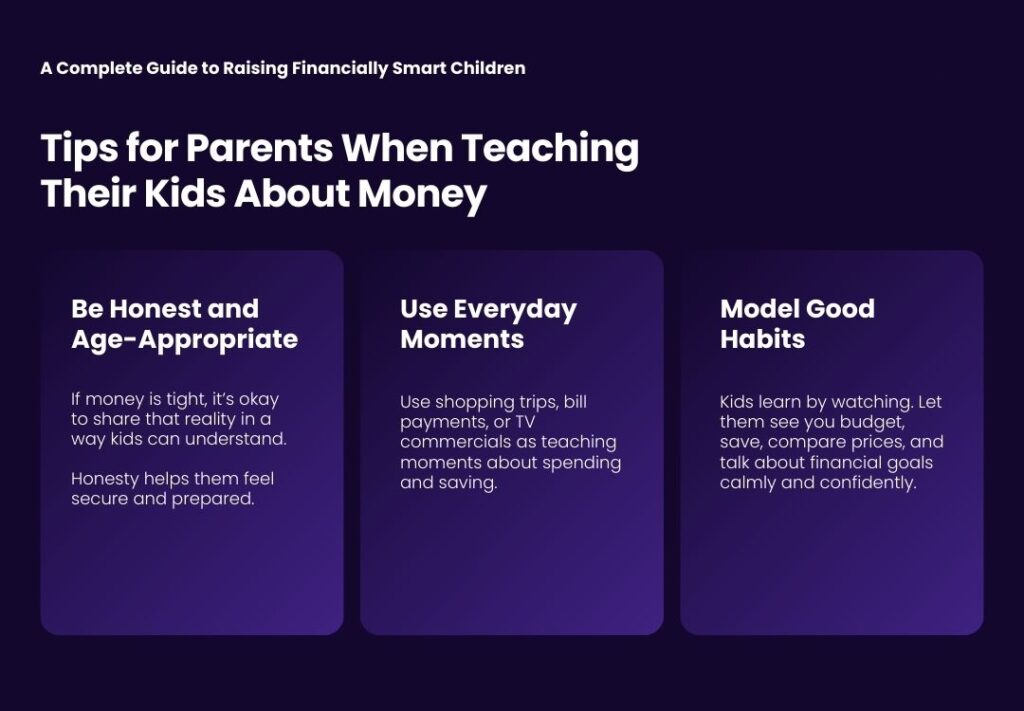

Tips for Parents When Teaching Their Kids About Money

1. Be Honest and Age-Appropriate

If money is tight, it’s okay to share that reality in a way kids can understand. Honesty helps them feel secure and prepared.

2. Use Everyday Moments

Use shopping trips, bill payments, or TV commercials as teaching moments about spending and saving.

3. Avoid Shame

Never make kids feel guilty or embarrassed about not knowing financial concepts. Money skills are learned, not inherited.

4. Model Good Habits

Kids learn by watching. Let them see you budget, save, compare prices, and talk about financial goals calmly and confidently.

5. Encourage Hands-On Learning

Give them chances to earn, save, and spend small amounts so they experience the value of money firsthand.

Here are a few apps that can help your kids save:

- PiggyBot: Helps kids track allowance and goals.

- Bankaroo: A virtual bank for kids to manage money.

- Savings Spree: Teaches kids about saving, spending, donating, and investing.

Raising Financially Confident Kids

Money touches almost every decision we make, from daily purchases to career and family plans.

Starting early whether it is pennies in a jar for a preschooler or a budgeting talk with a teenager lays the groundwork for lifelong skills.

Each small lesson adds up, shaping adults who feel empowered, not intimidated, by financial decisions.

Teaching kids about money goes beyond dollars and cents, it’s about building confidence, responsibility, and problem-solving skills.

Financial literacy equips them to make smart choices, set goals, and handle life’s challenges with independence.

It is never too early or too late to begin. Learning together can strengthen your financial knowledge while showing your child the value of continuous growth.

By raising financially smart kids, you are giving them a lifelong gift: the confidence and freedom to build the life they want.

[…] Building these habits early also teaches your child about money management later on, tying into the bigger picture of raising financially smart children. […]